Author

Formal insolvencies continue to increase in England and Wales with numbers currently 10% higher than in 2022. In particular, quarterly numbers for Q1 and Q2 2023 are higher than they have been since Q2 2009. To an extent, these figures are unsurprising given the headwind of challenges that businesses have faced in recent years with a hangover of increased borrowing from the Covid pandemic and high levels of inflation and interest rates all impacting cashflow negatively. There are still opportunities for businesses to be saved, and creditors protected, if the right advice is taken at the right time.

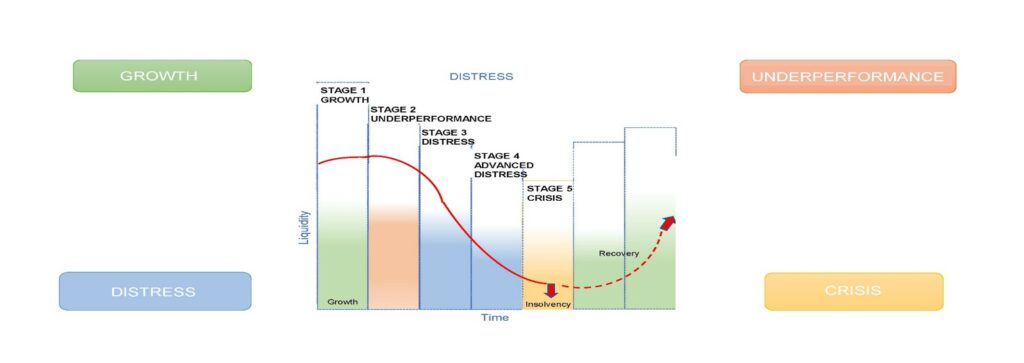

In this article we set out the warning signs of a business being in distress, and what steps can be taken at each stage, with a view to assisting directors and creditors in navigating this difficult time to achieve a positive outcome.

The Decline Curve, which can also be thought of as the lifecycle of a business, can broadly be categorised into four stages, as set out below

Stage 1: Growth

It may seem counterintuitive to think about distress or failure at a time of growth, but companies are constantly navigating change, not all of which may be positive. In particular, the current trend of high rates of inflation and interest are putting pressure on otherwise successful businesses. This may lead to a requirement for increased borrowing, or a sudden increase in borrowing costs when an existing funding arrangement expires.

Directors:

Understanding what funding options exist and who might be able to assist is very important and external professional advisors should be able to help with this. For example, Michelmores has a lot of experience dealing with development and bridging finance as well as other types of secured lending transactions and acts on behalf of a large number of leading banks, funds and alternative lenders who can assist our clients in securing new funding opportunities. We can provide guidance regarding the options available and function as a direct line into these organisations. We are happy to facilitate introductions between clients as well as undertaking specific transactions.

Stage 2: Underperformance

Underperformance may be displayed as stagnation or a failure to grow and might be short-lived in response to a temporary change in the market. However, it can also be an indicator that there is an underlying problem with cashflow control or an increase in costs.

Directors:

Your company may benefit from restructuring its borrowing to make it more affordable and ease financial pressure, or from taking advice from external advisers who can independently review the way your business operates.

Creditors:

It’s not always easy as a creditor to identify underperformance as the company’s operating style may not have changed. However, where there are warning signs of underperformance, or you are aware of pressures being faced more generally in the relevant sector, you may wish to review your terms of business with the company to ensure that your position has been protected as well as possible in anticipation of what might come next.

Stage 3: Distress

Entry into the Distress stage is often indicated when a business cannot fund any activity outside its immediate operations and subsequently has difficulty meeting its financial commitments. As a business travels further down the Decline Curve options available for survival become increasingly limited, so early action is paramount.

Directors:

If your company has not yet acted to restructure or resolve potential problems, this is the time. There are an array of tools outside of formal insolvency procedures that can be utilised. Appropriate legal advice should be sought on (1) the options available, (2) the crucial steps you should be taking to protect your position and (3) involvement of external advisers (from turnaround professionals to qualified Insolvency Practitioners).

Creditors:

At this stage you might be considering taking positive steps to seek immediate repayment of what you are owed. It is sensible to seek advice on the enforcement options available as well as the associated costs and risks.

Stage 4: Crisis

At this stage, a business is struggling to survive and unable to pay day-to-day debts. Directors may be seeking to hold creditors in abeyance and maximise cash receipts to avoid catastrophic action being taken by a third party. However, this does not have to mean the end. There are a number of options that can save jobs and allow the business to continue if the company receives the right advice in a timely manner.

Directors:

Legal advice should be sought on negotiations with third parties; how to avoid personal liability; and the strategic use of insolvency processes. We regularly work closely with boards of directors and external advisers in these situations in order to guide them through what can be an incredibly stressful and fast-moving period to ensure the best possible outcome is secured for all involved.

Creditors:

The situation may be out of your direct control at this stage as the relevant insolvency legislation is imposed for the benefit of all creditors, rather than individual ones. However, lawyers specialising in insolvency can help you navigate this period of uncertainty and take strategic steps to protect your position.

In times of change and uncertainty Michelmores can help by providing specialist support and advice. Should you wish to discuss any of the issues raised in this article, please contact Sacha Pickering.