In the first of a series of articles considering different insurance covers, our specialist policyholder insurance lawyers have teamed up with leading product recall consultancy firm RQA Group to consider product recall insurance; what is it, who is it for, what should companies look out for when buying cover and how can you best prepare for and manage a recall situation?

What is it Product Recall Insurance?

Product recall insurance covers manufacturers and distributors for the costs associated with recalling defective products from the market. Such costs can include customer notification expenses; transport and storage costs; the costs of disposal/destruction of the defective goods and so on. Some policies also provide cover for public relations and crisis management expenses, which can be crucial to a business’s continued survival where a product recall gives rise to substantial negative press interest; you might recall that back in November 2017, IKEA was forced to recall 29 million chests of drawers after a toddler in California was said to be the eighth child killed by the drawers toppling over.

Who is Product Recall Insurance for?

Manufacturers and distributors of all types of product should assess whether they ought to have product recall insurance. Other companies involved in the supply chain – for example, storage and transport companies – should also check their contractual arrangements to see if they could be liable for the costs of a product recall.

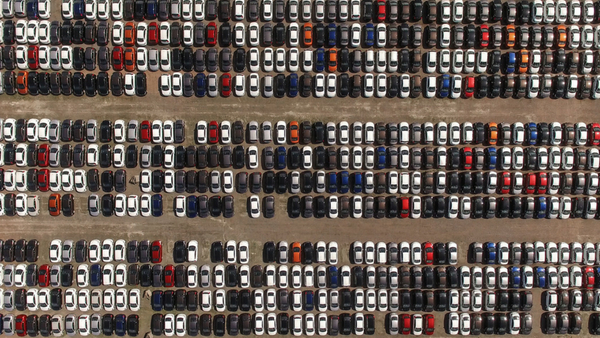

Research conducted by insurer Allianz in 2017 found that automotive companies are the most likely to make claims under product recall policies, followed by food & drink and domestic appliance manufacturers; this is not surprising given the obvious risk to consumers posed by such products if defective. Perhaps more surprising is the finding by Allianz that the average cost of a product recall claim was €12.4m in the automotive industry and €7.9m in the food industry.

It is a common misconception that only large manufacturers need to take out product recall insurance; any size company can be affected by the need to recall an unsafe product, and it is the smaller companies which may struggle to meet the costs of a recall without the assistance of insurance.

5 things to look for when buying cover – advice from our insurance lawyers

Product recall insurance comes in all shapes and sizes, so care must be taken to ensure that the cover purchased is the best fit for the policyholder and products in question. Here are just 5 things to consider (there are many more!):

- Voluntary recalls: what is the trigger for coverage under the policy? Are you covered if you decide internally that you want to recall a product due to potential safety concerns?

- Cross over with cyber cover: does the policy exclude cover for defects caused by hacking and other cyber events? If so, do you have separate cyber insurance cover that would cover those costs?

- Business Interruption: does the policy cover you for the loss of future sales incurred while a product is unavailable? If so, for what period are you covered and is that sufficient?

- Malicious tampering: are you covered for the costs of recalling a product which has been tampered with by a third party? What about where a third party has merely threatened to tamper with your products?

- Reputation: does the cover include brand/reputation protection costs? If not, is the recall of your product likely to generate negative press?

5 things to consider in recall management – advice from RQA Group

- Prevention is better than cure: Companies should take all measures necessary to reduce the likelihood of a product recall by ensuring they have effective product safety management procedures, well trained staff and only use approved suppliers.

- Have a plan: It is essential to have a product recall plan. Companies are very likely to experience a product recall and so it is essential to have a plan in place that assists the product recall team to execute the recall effectively. It will consider elements such as members of the recall team, decision making, escalation, communications, risk assessment, the recall and withdrawal processes.

- Training and testing: There is no point having a plan unless the product recall team knows it exists and understands how it can help them manage the recall situation. The recall team should also be tested annually in a simulated, scenario-based recall exercise.

- Communicate: Identify your stakeholders and who you need to communicate with e.g. consumers, retail customers, authorities, employees, suppliers etc. Decide the best channels for communicating with different parties e.g. phone / face to face (authorities) and social media (consumers). Make sure the message is consistent to all.

- Leadership: The company must demonstrate that they are in control of the issue, they have developed an effective action plan based on facts and they are acting in the interests of consumer safety. They must record all decisions and ensure actions are completed within deadlines to ensure the process does not get bogged down. If in doubt seek external expert support.