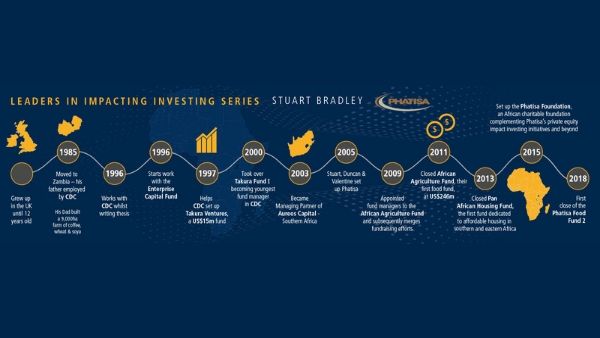

In the first of our Leaders in Impact Investing series, we speak to Stuart Bradley, joint Managing Partner of sector-specific African private equity fund manager Phatisa. Stuart shares some fascinating insights into his career journey in the impact investing sector, and discusses what the Phatisa team are doing to make a difference, by supporting projects with a positive social or environmental impact.

How did you get into private equity in Africa?

I grew up in the UK until the age of 12. My father, who was a farmer, moved the family to Zambia in the late 1980s. He eventually joined CDC (the UK Government’s and the world’s first development finance institution, founded in 1948), running two commercial farms. He built one of their farms in an area called Mazabuka, Nanga farms – a US$ 10 million investment ‒ on an estate of 9,000 hectares comprising coffee, wheat, soya and cotton. I stayed at boarding school in the UK. It was during these years, commuting between school and Zambia, that I became enthralled with Africa.

I joined the University of Nottingham in 1990 to study a BA in Industrial Economics followed by a Master’s in Corporate Strategy and Governance at Nottingham. One of the modules was private equity (interestingly, the Centre of Management Buyout Research was based in Nottingham at the time) and I was fascinated by it.

In 1995, I learnt CDC was starting up several country-specific private equity funds across emerging markets. I wrote to CDC requesting to do my Master’s thesis on private equity in Africa over the summer. Surprisingly, they said yes and sent me to Tanzania, where I spent the summer of 1996 in Dar es Salaam at the Tanzania Venture Capital Fund. I wrote my thesis and worked with the fund management team while I was there. After I graduated, they offered me a job and I joined CDC in London. I was sent to South Africa at the end of 1996 to work with the Enterprise Capital Fund.

How did you start putting together your own deals?

In 1997, I moved to Zimbabwe for three months with Rick Phillips. He was ex-3i Group and an experienced private equity practitioner (and now a partner at Actis, a leading emerging markets private equity firm). Rick had established Takura Ventures, a US$ 15 million Zimbabwe-focused private equity fund with the objective of achieving long term capital appreciation. As general manager, he convinced CDC to keep me there for two years and, in return, he would send back a fully trained private equity dealer.

Rick, who had just done Takura’s first deal, said: ‘Right Stuart, whatever you’ve learnt to date, forget it.’ He put me on a 3i training programme – in our first meeting, I carried his briefcase and said nothing; in the second meeting, I took notes. Bit by bit, he gave me more of the deal; the financial model, investment committee paper, negotiations and deal legals. I went through that training with him, and after 12 months I was flying solo.

We felt there was a deep market for management buyouts in Zimbabwe given the country’s sanctions history, which had created domestic conglomerates. External investment was not allowed so everything was reinvested internally. Nobody was doing deals like that in Zimbabwe at the time and we had the technology. We did 15 deals, including 11 management buyouts in various businesses. After two years, Rick was posted to Malaysia and I took over. I was the youngest fund manager at the time for CDC, running a fund in Zimbabwe and part of a worldwide chain of 14 funds.

By then, Zimbabwe’s economy was collapsing and we started to exit. We made a 27% US dollar return on those exits, against the Zimbabwe dollar which devalued 50,000% over the same period. We did phenomenally well and delivered great returns through a tough economic cycle. This was purely attributable to the basics; backing good management teams, incentivising and aligning them, entering at low multiples and structuring to protect against currency issues.… They were exciting days, and pioneering from an African private equity perspective.

What was the driver for establishing Phatisa?

Even while at CDC, I aspired to create my own business. Running Phatisa today, along with Duncan Owen and Valentine Chitalu – colleagues I worked with closely at CDC ‒ is a real honour.

When Duncan (who ran CDC’s Africa portfolio; 16 businesses; seven countries; 28,000 employees; with a US$ 100 million turnover), Valentine (until recently a main board director of CDC and previously CEO of the Zambian Privatisation Agency) and I came together in 2005, it was early days in African private equity and there weren’t many fund managers. We saw an opportunity to do something different. To build a sector-focused fund manager bringing together our different backgrounds and skill sets to create real value addition capabilities within the firm. Together, we established Phatisa, now recognised as one of the leading African development and private equity fund managers with three funds under management in the food and housing sectors.

What’s your mission and what do you do differently?

Firstly, what we offer investors/limited partners (LPs) is financial returns: 2.5 or 3 times is what we’re targeting. But whatever we look at, it has to be impactful. Investing in the food and housing sectors in Africa (Phatisa’s investment sectors) on a growth strategy means you are creating impact. At the same time, our value addition is all about improving businesses and making them more attractive to drive the exit. Everything we do commercially will drive positive impacts in Africa.

We can make a meaningful difference ‒ especially in environmental, social and governance considerations ‒ by more effectively looking after people and the planet in and around our investments. In every one of our businesses we find so much we can do; we measure and grow those businesses, creating jobs and improving livelihoods. Measuring the impact is critical. We want to build. That’s our mantra.

Phatisa is deeply differentiated from a portfolio capability, value-addition point of view. Our transactional and operational teams genuinely work hand in hand, as a team, on each of our investments. Physically, the teams sit close together, they spend time together and all attend one another’s pipeline and portfolio meetings. This collaboration is a strong differentiator but it doesn’t work for everyone.

What is an average working day like?

There is a natural cyclicality to my work. Presently, our fundraising cycle is driving much of my day, together with looking after our existing LPs and relationships. I travel a lot currently because of this. I have my day job, too, managing the firm with my partners and the day-to-day matters that arise. I’m also assessing new deal opportunities with the team, helping with portfolio company challenges, catching up with my colleagues on progress and generally making sure I’m up to speed with everything. In reality, no day is the same; the fun of private equity is the challenge and we get plenty of that.

Who are Phatisa’s investors?

At the moment in the African Agriculture Fund (our first fund), 90% of the investors are development finance institutions (DFIs) with the likes of the US Government’s Overseas Private Investment Corporation (OPIC), various European DFIs and African development banks such as the African Development Bank. The remaining 10% are commercial LPs: fund of funds, banks, family offices and strategic investors focused on investing in food and agri-businesses and we are the ideal partner. Our second fund, the Pan African Housing Fund, is 100% DFI.

At first close, the balance in our second food fund – the Phatisa Food Fund 2 ‒ has shifted to 80% commercial investors and 20% DFIs. This profile will likely swing slightly as we move towards final close. Importantly, the DFIs will always form a core part of our business as they must be there. International commercial fundraising is tough in the current climate, and that’s when the DFIs are crucial to the sustainability of investing in these markets. After all, this is part of development.

What attracts investors?

This varies for different investors. For DFIs it’s what they do; their mandate is to provide risk capital to fund development. Impact investors want not only to make a financial return, but also generate a measurable social or environmental impact. Sub-Saharan Africa is a huge success story in this respect. Commercial investors are often looking for diversification. We might be tiny in terms of their overall exposure, but having an allocation to Africa is part of their balance.

Of course, the fundamental macros of Africa are important to this narrative, with population growth and urbanisation underpinning the development thesis. We are experiencing strong growth levels in many of the regions we target.

Can you tell us a bit about one of your investments?

Meridian is a good example. Meridian is a prominent agricultural inputs business, operating across four countries. We began our investment to grow the business in 2014 and invested US$ 32 million. All this money has gone directly into development and expansion capital. We brought in co-investors and together we held a majority stake. Through our investment, we have taken the business from 200 000 tonnes of fertiliser per annum to over half a million tonnes today and we are generating revenues in excess of US$ 300 million. We have achieved this through capacity increases, granulating plants, warehousing and storage facilities (which are imperative if you’re going to move lots of fertiliser around Southern Africa). We’ve also tripled the EBITDA, a massive growth. At the same time, we provided significant impacts; we trained over 13,000 smallholder farmers (of which 70% are women) on better use of fertilisers and demonstrated an increase in yields of between 18% to 30% at zero additional cost.

We recently signed an agreement to exit Meridian to Ma’aden, a Saudi-listed resources company whose global presence and integrated supply chain will strengthen Meridian’s market presence, thereby driving solid returns.

What’s the balance between profit and positive impact?

At Phatisa, we believe one cannot happen without the other. We are not just going to invest for impact and make a loss; we have got to turn a profit. Equally, we will not merely look at profit if we cannot demonstrate positive impact. They are two sides of the same coin at Phatisa. They are not mutually exclusive by any means. The way we are investing, we prove they are mutually inclusive. We firmly believe doing good is better business.

What specific support do Joe Whitfield and the Michelmores’ team provide Phatisa?

As well as leading Michelmores’ Emerging Markets and Impact Investment team, Joe is our General Counsel. Phatisa has a strong CDC pedigree and when we were there, Joe was CDC’s General Counsel. We’ve worked with him across all our funds and share a long, trusted history.

Joe is part of the team and supports and advises us along the way. He is always there when we need him, providing counsel across many issues, whether fund or deal-related or concerning HR or LP relations. He has built a recognised African practice with Michelmores and is doing a lot of work for the DFIs and other impact investors in this region.

Michelmores has advised on a number of our deals from the inception of our first fund. Being involved in the fund structuring and the structuring of our investments has given Joe unique insight of how to take things forward; how to evolve our legal frameworks and our approach the next time round. He is integral to the history and establishment of Phatisa.

Let us not forget: whether it be legal issues or other considerations ‒ regulatory and general investment climate ‒ Africa is not one country. Each nation has its own laws and interpretation. We are constantly learning and adapting our thinking, structures and approach. While our deals tend to be structured through Mauritius and apply English law, they are multi-jurisdictional and complex. Joe has more than 25 years’ experience of doing deals across Africa and other emerging markets, and has lived in numerous African countries. He has first-hand knowledge of the environment in which we operate and this enables him to provide practical counsel not only in terms of the legals, but also the wider dynamics required to get deals done.

What in your career journey are you most proud of?

It really has been a journey of piecing together my passions: Africa, private equity, relationships and impact. The people do make the difference – in every way – their skill, experience and energy are what has made Phatisa different.

Of course, the job is never finished. This is what wakes me up each morning and energises my day. Attracting more capital to Africa, building the team, finding businesses where we can make a positive contribution and, ultimately, seeing this translate into meaningful financial and impact returns is what makes me proud. It sounds trite but seeing those businesses grow and the people and communities around them; that’s what makes my role fulfilling. It is more than business. It’s about purpose.

For more information on Phatisa and to read about some of the projects it supports, please read the fund-specific Phatisa Impact Reports:

AAF Development Impact Report: for the period 2014 – 2018, Phatisa, 2018

PAHF Development Impact Report: for the period 2014 – 2017, Phatisa, 2018