Michelmores’ Emerging Markets team has been ranked by Legal 500 for its Emerging Markets investment work, alongside global firms such as Latham & Watkins, Debevoise Plimpton, Charles Russell Speechly, and Berwin Leighton Paisner. Legal 500 commented on the team’s ‘open, accessible, pragmatic and commercial’ lawyers, and made particular mention of the firm’s ‘very strong Africa team’.

Legal 500 is one of the leading independent directories of law practices in the UK and independently reviews the practices of more than 1,000 UK law firms, teams and individuals, and the work that they have undertaken over the last 12 months.

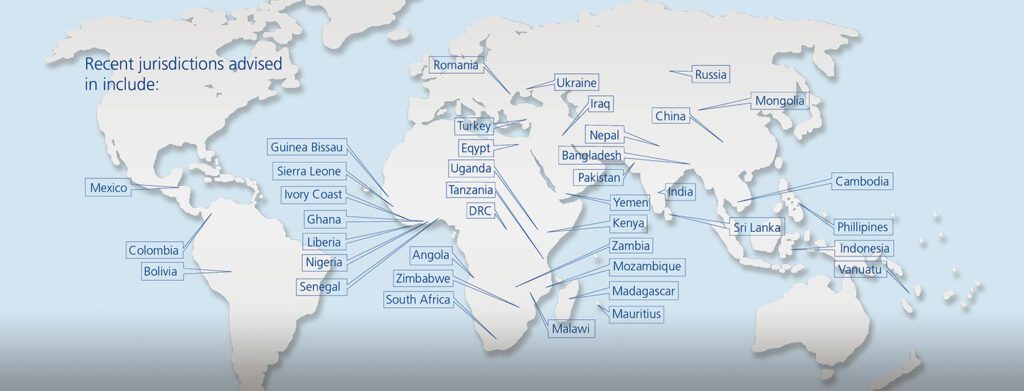

Led by Joe Whitfield (formerly General Counsel of CDC, the UK Government’s Development Finance Institution, and who has more than 20 years’ experience working in the emerging markets), Michelmores’ Emerging Markets team has considerable cross border expertise, representing a broad range of clients (including private equity firms, development finance and other financial institutions, and impact investors) investing in some of the most challenging jurisdictions. Recent jurisdictions that the team has worked in include Sierra Leone, Mozambique, Rwanda, Cambodia, Laos, Mongolia, the Philippines and Mexico.

Joe Whitfield commented,

“This is the first time that the team has submitted an application to Legal 500, so we are delighted that our emerging markets work has been recognised. Our practice continues to grow and we have enjoyed a very busy 2015 to date, working across diverse and exciting jurisdictions including Mozambique, Nigeria, Tajikistan, Thailand and Zimbabwe”.